Copier Lease vs. Purchasing: Which is Right for Your Business?

Copier Lease vs. Purchasing: Which is Right for Your Business?

Copier lease is a decision that many businesses in the Philippines face when it comes to acquiring essential office equipment. The choice between leasing and purchasing a copier is not always straightforward, as each option comes with its own set of advantages and considerations. This detailed guide aims to help you navigate this decision-making process, ensuring you make the right choice for your business’s document management needs. By examining the pros and cons of both leasing and purchasing, we provide insights into how each option can impact your business operationally and financially, helping you to weigh which path aligns best with your company’s goals and budget.

In exploring the options for copier solutions in the Philippines, it’s crucial to consider the benefits of copier leasing and copier lease Philippines tailored to meet the diverse needs of businesses. Copier leasing offers the advantage of keeping your office equipped with the latest technology without the full expense and commitment of purchasing. This flexibility is especially beneficial for businesses looking to manage their cash flow more effectively while still accessing high-quality document management solutions. Additionally, leasing agreements often include maintenance and service, reducing the worry about potential downtimes and ensuring your operations run smoothly. This guide will delve deeper into how opting for a copier lease can enhance your business’s efficiency and productivity, presenting a compelling case for why leasing might be the most advantageous route for your document management strategy.

Understanding Copier Leasing and Purchasing

Before diving into the specifics, it’s essential to understand the fundamental differences between copier leasing and purchasing.

Copier Leasing:

Involves renting a copier from a leasing provider for a specified period, typically with monthly payments.

Provides financial flexibility, as it requires less upfront capital compared to purchasing.

Often includes maintenance and support services, reducing downtime and hassles.

Allows businesses to access the latest copier technology through regular upgrades.

Copier Purchasing:

Involves buying a copier outright, making it a capital expense with a significant upfront cost.

Provides ownership of the copier, offering long-term asset value.

Requires the business to manage maintenance and repair expenses separately.

May lead to potential obsolescence as copier technology evolves.

Benefits of Copier Leasing

Financial Flexibility: Copier leasing conserves capital, making it an attractive option for businesses looking to manage costs effectively.

Access to Advanced Technology: Leasing ensures access to the latest copier models, keeping your document management processes efficient and competitive.

Maintenance and Support: Many leasing agreements include maintenance and support services, reducing downtime and hassles.

Tax Benefits: Lease payments are often tax-deductible as operating expenses, offering potential tax advantages.

Flexibility to Scale: Copier leasing provides the flexibility to scale your copier setup based on your changing needs, ensuring you’re not stuck with outdated equipment.

Benefits of Copier Purchasing

Ownership: Purchasing a copier means you own the asset, and it becomes a long-term business investment.

No Monthly Payments: Unlike leasing, purchasing doesn’t involve ongoing monthly payments, reducing financial obligations.

Total Control: With ownership comes complete control over the copier, including maintenance and repairs.

Long-Term Asset: A purchased copier can retain value and serve your business for many years.

Now that you have a basic understanding of copier leasing and purchasing let’s delve deeper into the factors to consider.

FAQs (Frequently Asked Questions)

1. Is copier leasing more cost-effective than purchasing? Copier leasing is often more cost-effective in the short term due to lower upfront costs, but the long-term costs depend on your specific needs.

2. Can I upgrade my copier during a lease agreement? Yes, many leasing agreements allow for copier upgrades to keep up with technology advancements.

3. What tax benefits are associated with copier leasing? Lease payments are typically tax-deductible as operating expenses, offering potential tax advantages.

4. Do I have to handle maintenance and repairs with a leased copier? Many leasing agreements include maintenance and support services, reducing the need for you to manage repairs.

5. Can I purchase the copier at the end of the lease term? Yes, many lease agreements offer the option to purchase the copier at fair market value or a predetermined price.

6. How can I determine if leasing or purchasing is better for my business? Consider factors like your budget, long-term copier needs, and cash flow to decide which option aligns with your business goals.

7. Are there any restrictions on copier usage with leasing agreements? Leasing agreements may have usage limits, so it’s essential to understand these terms to avoid penalties.

8. What are the potential downsides of purchasing a copier outright? Purchasing involves a significant upfront cost and may lead to potential obsolescence as copier technology evolves.

9. Can I deduct the cost of a purchased copier on my taxes? Depending on your tax jurisdiction, you may be able to deduct depreciation expenses for a purchased copier.

10. How do I determine the total cost of ownership for a purchased copier? Consider upfront costs, maintenance, repairs, and potential upgrades to calculate the total cost of ownership.

Conclusion

In conclusion, the decision between copier leasing and purchasing depends on your business’s unique needs, budget, and long-term goals. Copier leasing offers financial flexibility, access to advanced technology, and maintenance support, while purchasing provides ownership and control. Assess your specific requirements and consult with experts to make the right choice.

Don’t hesitate to reach out to us at Marga Enterprises for personalized guidance on whether copier leasing or purchasing is the best fit for your business.

Call To Action

Contact us at 09171642540, 09614481276, 02-721-69-415, or email marga.enterprises2013@gmail.com for personalized service and expert advice. to explore our range of copier lease options and find the perfect fit for your business needs.

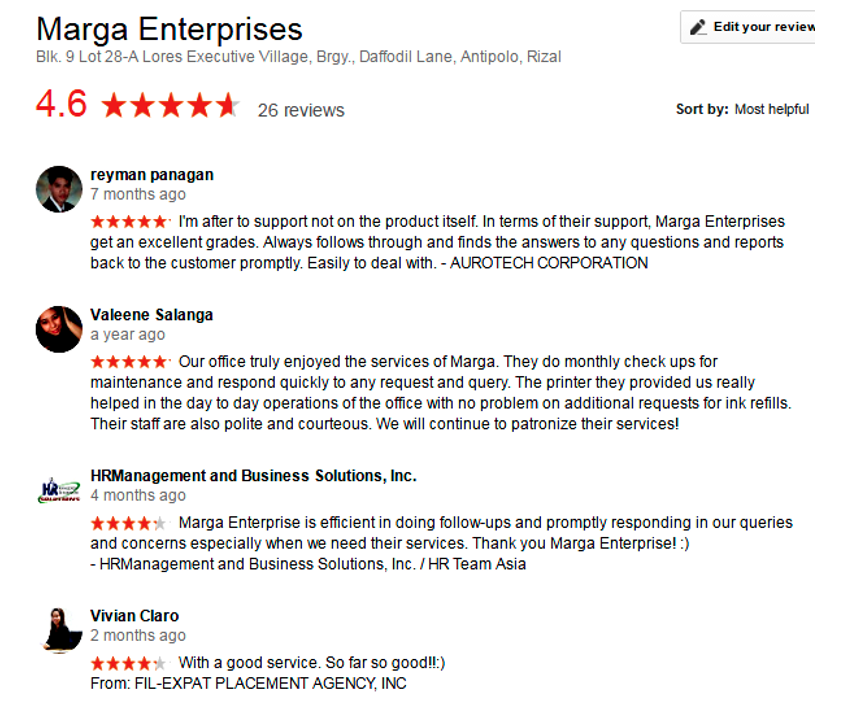

CLIENT TESTIMONIAL