Comprehensive Guide to Copier Lease for Small Businesses in the Philippines

Comprehensive Guide to Copier Lease for Small Businesses in the Philippines

In the ever-evolving landscape of small businesses in the Philippines, one strategic decision can significantly impact your efficiency and productivity: copier lease. Copier leasing is more than just a financial transaction; it’s a means of accessing advanced office technology without the initial capital outlay. As small businesses strive to stay competitive, the flexibility and cost-effectiveness of copier leasing align perfectly with their dynamic needs. This comprehensive guide explores the strategic advantages and considerations of copier leasing, aiming to provide small businesses with the insights they need to make informed choices (copier lease Philippines).

Copier leasing is more than just a financial transaction; it’s a means of accessing advanced office technology without the initial capital outlay. As small businesses strive to stay competitive, the flexibility and cost-effectiveness of copier leasing align perfectly with their dynamic needs. This approach offers several benefits: access to the latest copier models, regular maintenance and upgrades, and the avoidance of obsolescence, all while keeping expenses predictable and manageable. It allows small businesses to enjoy the benefits of modern office equipment without the burden of significant upfront costs, providing a practical solution to their document management challenges. This guide delves into how copier leasing can be a game-changer for small businesses in the Philippines, helping them to remain agile and responsive in an increasingly competitive market.

Benefits of Copier Leasing:

Cost-Efficiency: Copier leasing enables you to spread the cost of acquiring a copier over a manageable monthly fee, preserving your capital for other essential investments.

Access to Advanced Technology: Stay up-to-date with the latest copier technology without the hassle of frequent equipment upgrades.

Flexibility: Copier lease agreements are customizable, allowing you to choose terms that match your business’s unique requirements.

Maintenance and Support: Many copier lease agreements include maintenance and support services, ensuring your equipment runs smoothly.

Tax Advantages: Leasing expenses may be tax-deductible, providing potential financial benefits for your small business.

Exploring Copier Lease Options:

Before diving into copier leasing, it’s crucial to understand your specific business needs. Consider factors like the volume of printing, required features (such as color printing or scanning capabilities), and budget constraints. Additionally, research different copier lease providers to find the one that aligns with your business goals.

Frequently Asked Questions (FAQs):

To help you navigate the copier leasing landscape, here are ten frequently asked questions and their answers:

FAQ 1: What is Copier Leasing? Copier leasing is a contractual agreement that allows a business to use a copier machine for a specified period, typically 24-60 months, in exchange for regular monthly payments.

FAQ 2: How Does Copier Leasing Work? In a copier lease, the business chooses a copier machine, signs a lease agreement, and makes regular payments for the duration of the lease. At the end of the lease, the business can typically choose to purchase the copier, return it, or upgrade to a new model.

FAQ 3: What Are the Advantages of Copier Leasing for Small Businesses? The advantages include cost-efficiency, access to advanced technology, flexibility, maintenance and support, and potential tax benefits.

FAQ 4: Are Maintenance and Repairs Included in Copier Lease Agreements? Many copier lease agreements include maintenance and repair services, ensuring that the copier remains in good working condition.

FAQ 5: Can I Upgrade My Copier During the Lease Term? Yes, many lease agreements allow for copier upgrades, providing flexibility as your business grows.

FAQ 6: Is It Possible to Cancel a Copier Lease Agreement Early? It’s essential to review the terms of your lease agreement, as canceling a lease early may incur penalties.

FAQ 7: Are There Tax Benefits to Copier Leasing? In some cases, copier lease payments may be tax-deductible as a business expense. Consult with a tax professional for guidance.

FAQ 8: What Happens at the End of the Lease Term? Typically, businesses have the option to purchase the copier at its fair market value, return it, or lease a new copier.

FAQ 9: How Do I Choose the Right Copier for My Business? Consider factors such as your business’s printing volume, required features, and budget when selecting a copier.

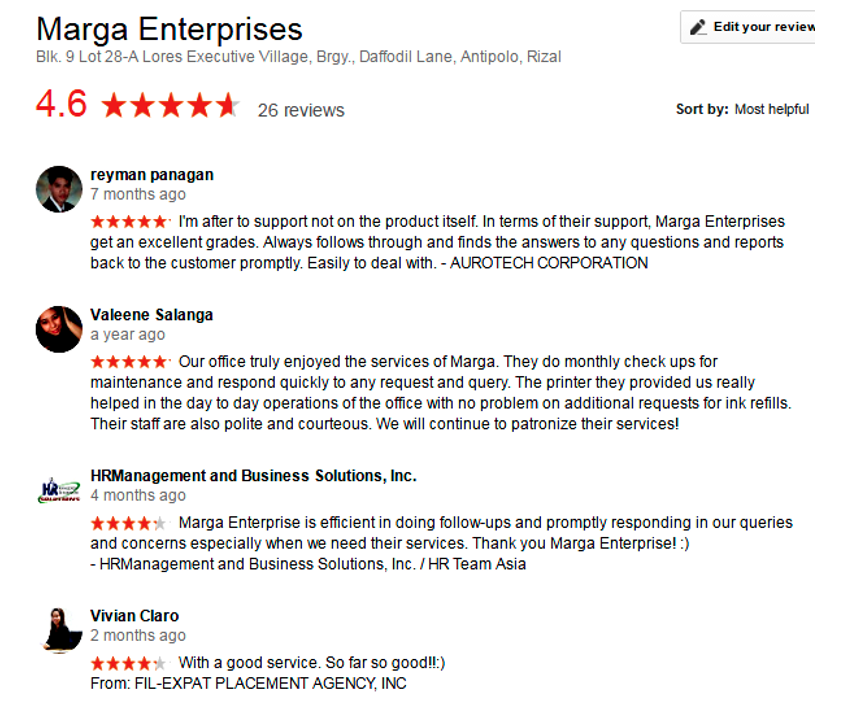

FAQ 10: Where Can I Find Reliable Copier Lease Providers in the Philippines? Reputable copier lease providers in the Philippines include Marga Enterprises and several others, each offering various lease options.

Conclusion

Copier leasing can be a game-changer for small businesses in the Philippines. It provides access to advanced office technology without the financial burden of outright purchase. By understanding your business needs, exploring lease options, and considering the benefits, you can make an informed decision that enhances your small business’s efficiency and competitiveness.

Call to Action:

Ready to explore copier leasing options tailored to your small business? Contact Marga Enterprises today at 09171642540, 09614481276, or 02-721-69-415, or email us at marga.enterprises2013@gmail.com for personalized assistance.

CLIENT TESTIMONIAL