Looking for a reliable copier and printer rental provider in the Philippines? We're here to help. Our team delivers quality printers, copiers, and complete support so your business can work smarter—without the high cost of ownership.

At the heart of our service is a simple promise: quality equipment at affordable rates. Furthermore, we believe every business deserves reliable printing solutions that fit their budget. Therefore, we offer flexible plans designed to maximize value—without sacrificing performance, reliability, or service.

Whether you're a growing startup, a school, or an established enterprise, choosing us means partnering with a provider who puts your productivity first. From smooth installation to fast technical support, we’re committed to making copier and printer rentals easy, efficient, and worth every peso.

Copier Rental Plans and Printer Options

Our copier rental plans start at ₱1,250/month and include everything your business needs—printer, toner, repairs, and full support. Choose the ideal solution for your office, whether you need mono, color, or A3 copier rental options.

📄 Get Full Pricing Guide

Affordable Copier Rental

The best copier rental deals offer advanced technology and high-quality output for businesses across the Philippines.

The Ricoh 2551 delivers clear black-and-white prints and fast performance, ideal for affordable copier rental needs.

Renting from Marga Enterprises provides both savings and convenience with top copier lease options in the market.

Heavy Duty Copier Rental

Copier rental solutions like the BH 363 Konika boost efficiency and quality for small businesses in the Philippines.

Looking for a copy machine rental? The BH 363 Konika is built for modern, fast-paced business needs.

This wireless copier offers high-quality prints and integrates smoothly into any office setup.

Print and scan from anywhere in your workspace with ease.

Choose our copier rental service today and power up your productivity with the BH 363 Konika.

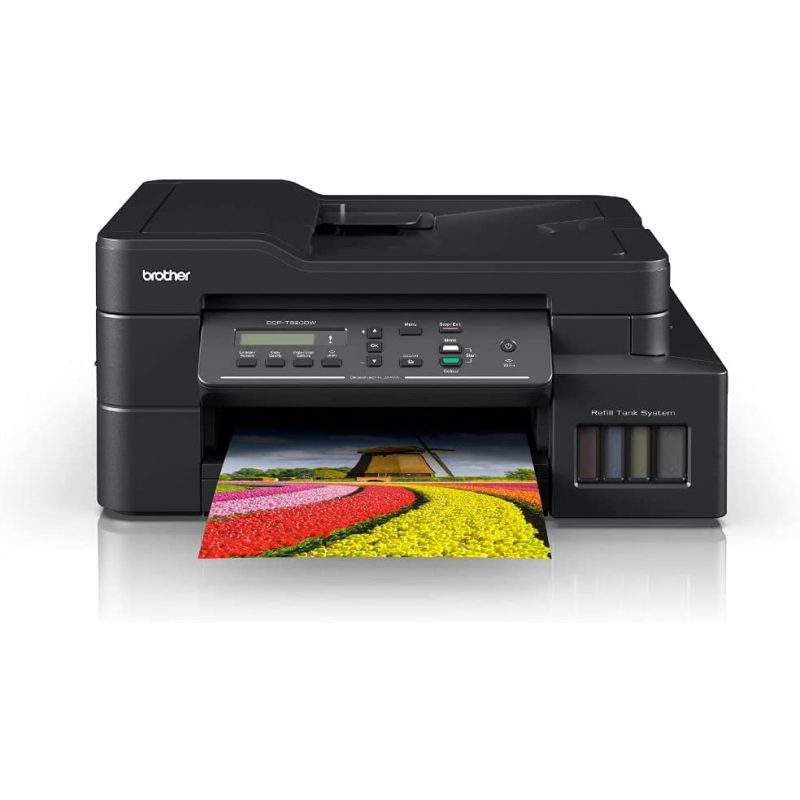

Printer Rental

Marga Enterprises offers the Brother 3930 All-in-One for reliable printer rental services in the Philippines.

Looking for a quality printer for rent? The Brother 3930 is perfect for printing, scanning, copying, and faxing.

It features advanced functions and easy connectivity for smooth, efficient office workflows.

Print or scan directly from your smartphone or tablet with its mobile-ready features.

Choose our copier rental service and boost your business productivity with the trusted Brother 3930.

Wireless Copier Rental Machine

Marga Enterprises now offers the Brother 3930 All-in-One copier for rent in the Philippines.

It combines printing, scanning, copying, and faxing in one powerful device.

Ideal for mobile copier rental, it boosts workflow with advanced features and seamless connectivity.

Print documents, scan contracts, or copy files—all with professional results.

The Brother 3930 supports mobile printing from smartphones and tablets for added convenience.

Experience reliable service and great copier rental deals from the Best Printer Rental Company.

Rent the Brother 3930 today and boost your business productivity.

Multifunction Copier Rental Machine

Discover the Canon IR3245—perfect for fast, versatile printing through Marga Enterprises' copier and printer rental service.

Need a black and white printer or copier on rent? The IR3245 is your reliable, high-speed solution.

This color laser printer boosts productivity with fast output and sharp, professional-quality prints.

Ideal for any business size, it handles everything from important documents to eye-catching marketing materials.

Our rental service offers dependable desktop copiers tailored to your business needs.

The Best Copier Rental Deals

Why Choose Copier Rental?

Copier rental is a smart financial decision for businesses of all sizes.

Purchasing a copier can strain your budget, especially with other overhead costs. However, rentals offer predictable monthly payments—making them a smarter, more manageable option. Additionally, with Marga Enterprises, you gain 24/7 support to quickly resolve issues like paper jams or service errors. As a result, renting copiers becomes more than a cost-saving measure—it's a strategic advantage.

Adaptability and Innovation

Stay ahead with access to the latest copier technology.

One key benefit of copier rental is flexibility. Instead of being stuck with outdated hardware, businesses can upgrade to newer models as technology evolves. This ensures your team always has access to modern features and improved functions. Consequently, your document workflows remain efficient, modern, and competitive.

Risk Mitigation

Avoid the pitfalls of equipment depreciation.

Another compelling reason to rent is risk management. Buying a copier means dealing with depreciation and obsolescence. But with copier rental, the burden of outdated equipment shifts to the provider. This ensures your machines stay current, functional, and aligned with your operational needs—without the long-term risk.

Scalability for Seasonal Demands

Effortlessly scale your equipment during peak seasons.

Many businesses face seasonal spikes in printing and copying needs—like during tax season or end-of-year reporting. Copier rental gives you the ability to scale up temporarily without investing in equipment that will later sit unused. This ensures cost-efficiency while still meeting fluctuating demand.

Focus on Core Competencies

Choosing a scanner or copier for rent allows businesses to concentrate on what they do best.

Instead of managing copiers in-house, which requires ongoing repairs and upgrades, you can rely on expert support.

As a result, your team saves time and energy, which can be redirected toward growth and innovation.

Cost Allocation and Predictability

Additionally, copier rental offers cost predictability, making budgeting easier and more accurate.

Our rental deals often include maintenance, repairs, and supplies—so no surprise expenses.

This is especially helpful for startups and small businesses working with tight budgets and managing cash flow carefully.

Beyond Cost Savings

More than just saving money, copier rental is a smart strategic move.

It allows companies to stay flexible, scale as needed, and reduce operational risks.

With the Best Copier Rental Deals, your business remains agile and focused on its core activities.

Making the Right Choice

Before signing a rental agreement, first assess your needs.

Do you need only black and white printing—or color as well?

Next, consider if you need wireless features, scanning, or faxing capabilities.

Finally, don't forget your budget. Fortunately, the rental market is flexible—there's a perfect copier deal for everyone!

Here's a handy table to guide you:

Consideration | Options |

|---|---|

Type | Black & White, Color |

Features | Wireless, Scan, Fax, Multifunction |

Budget | Economy, Standard, Premium |

Best deals and tips regarding the best best copier rental deals

Special Offers and Promotions:

The rental provider may have periodic promotions or special offers for new clients, such as discounted rates for the first few months of rental or bundled packages that include additional services like maintenance and toner replacement at no extra cost.

Flexible Rental Plans

Highlighting the versatility of print all you can rental Philippines plans, the provider offers a range of options including short-term rentals, long-term leases, and customizable packages. These are designed to accommodate various business requirements and budgets, ensuring that companies can find the perfect solution to meet their printing needs.

Equipment Selection Guide

Provide a guide or overview of the different copiers and printers available for rental, highlighting the key features, specifications, and recommended use cases for each model. This can help clients make informed decisions based on their specific requirements.

Tips for Maximizing Efficiency

Offer tips and best practices for maximizing efficiency when using rental copiers and printers.

Cost-Saving Strategies

Share cost-saving strategies and recommendations, such as choosing energy-efficient models, implementing print management software to track usage and reduce waste, and exploring options for recycling used consumables.

FAQ about the Best Copier Rental Deals

What services does No. 1 Copier & Printer Rental Provider in the Philippines offer?

This question addresses the range of services provided by the rental provider, such as copier and printer rental, maintenance, repair, and support services.

What types of copiers and printers are available for rental?

Potential clients may want to know about the variety of copiers and printers offered by the rental provider, including black-and-white and color machines, multifunction printers, and production printers.

What are the rental terms and conditions?

Clients often inquire about the duration of rental agreements, payment terms, renewal options, and any additional fees or charges associated with the rental service.

Is technical support included in the rental agreement?

This inquiry explores whether printer lease agreements include comprehensive technical support, troubleshooting, and maintenance services throughout the duration of the lease, ensuring uninterrupted operations and support.

Do you provide consumables like toner and paper?

Clients may ask about the availability of consumables such as toner cartridges, paper, and other supplies, and whether they are included in the rental package.

Can I upgrade or downgrade my rental equipment during the contract period?

This question pertains to the flexibility of the rental agreement, including the possibility of upgrading to newer models or downsizing equipment based on changing business needs.

What is the process for returning rental equipment at the end of the contract?

Clients may want to know about the the Best Copier Rental Deals procedures for returning rental equipment, including any required maintenance or cleaning before returning the devices.

Are there any penalties for early termination of the rental agreement?

This question addresses whether there are penalties or fees associated with ending the rental contract before the agreed-upon term.

Can I schedule regular maintenance visits for the rental equipment?

Clients may inquire about scheduling regular maintenance visits to ensure optimal performance and prolong the lifespan of the rental equipment.

Is there an option to purchase the rental equipment after the rental period?

This question addresses whether clients have the option to buy the rental equipment at the end of the rental agreement and if any discounts or incentives are offered for purchasing.

Best deals and tips regarding the Best Copier Rental Deals:

Special Offers and Promotions:

The Best Copier Rental Deals rental provider may have periodic promotions or special offers for new clients, such as discounted rates of bundled packages that include additional services. (like maintenance and toner replacement at no extra cost and print unlimited.)

Flexible Rental Plans:

Highlight the flexibility of the rental plans offered by the provider, including options for customizable packages tailored to suit different business needs.

Equipment Selection Guide:

Provide a guide or overview of the different copiers and printers available for rental. This can help clients make informed decisions based on their specific requirements for the best copier rental deals.

Tips for Maximizing Efficiency:

Offer tips and best practices for maximizing efficiency when using rental copiers and printers, such as setting up default print settings and scheduling regular maintenance checks.

Cost-Saving Strategies:

Share cost-saving strategies and recommendations, like choosing energy-efficient models. Can also implement print management software to track usage and reduce waste, and exploreoptions for recycling used consumables of the best copier rental deals.

Customer Support and Assistance:

Emphasize the provider's commitment to customer support and assistance, including a dedicated helpline or support team available for technical queries, troubleshooting assistance, and guidance on optimizing the use of rental equipment of the printer rental company.

Testimonials and Reviews:

Showcase positive testimonials and reviews from satisfied clients who have experienced the benefits of renting copiers and printers from the No. 1 provider of the best copier rental deals. This can instill confidence in potential clients and demonstrate the provider's track record of delivering quality services.

Upgrade Options and Technology Trends:

Inform clients about upgrade options available during the rental period to stay ahead in the competitive market.

Security Features and Data Protection:

Highlight the security features of the rental equipment to assure clients of data protection with the best copier rental deals.

Sustainability Initiatives:

Discuss any sustainability initiatives or eco-friendly practices adopted by the rental provider. Use paperless solutions to minimize environmental impact. The Best Copier Rental Deals.

Conclusion

In summary, our copier rental deals offer businesses a cost-effective way to boost productivity. With flexible plans, quality equipment and reliable support, we stand out as a trusted partner for businesses of all sizes. From expert tips to upgrade options, we help streamline document management and cut costs—making copier rentals essential for modern offices.

If you're convinced (or just curious), why not give copier rental a try? For any inquiries or to explore some incredible options, do reach out to us. Just call 09171642540 / 09614481276 / 02-721-69-415 or shoot an email to marga.enterprises2013@gmail.com. Remember, the right equipment can make a world of difference in the best copier rental deals!

Ready to level up your business efficiency? Contact us now!